Brochure advertising is a crisis winner

Author: Jens-Peter Gödde, Senior Project Manager at IFH COLOGNE

Persistently high inflation: The influence of price increases on the use and perception of channels for communicating offers. Print advertising is a crisis winner as an actively used and passively perceived channel

Inflation remained high in June 2023: according to estimates by the Federal Statistical Office, it was +6.4% – a (re)increase of 0.3 percentage points compared to the previous month. In a specialist article last month, we described the consequences of the sharp price increases on purchasing power and consumer sentiment in detail. Our conclusion: offer-centered shopping is becoming more important, for example through increased visits to discount stores or increasing online purchases. There is also a growing willingness to switch to stores with better offers. However, the choice and perception of channels is also changing rapidly – driven by strong inflation – and it is important to keep an eye on this.

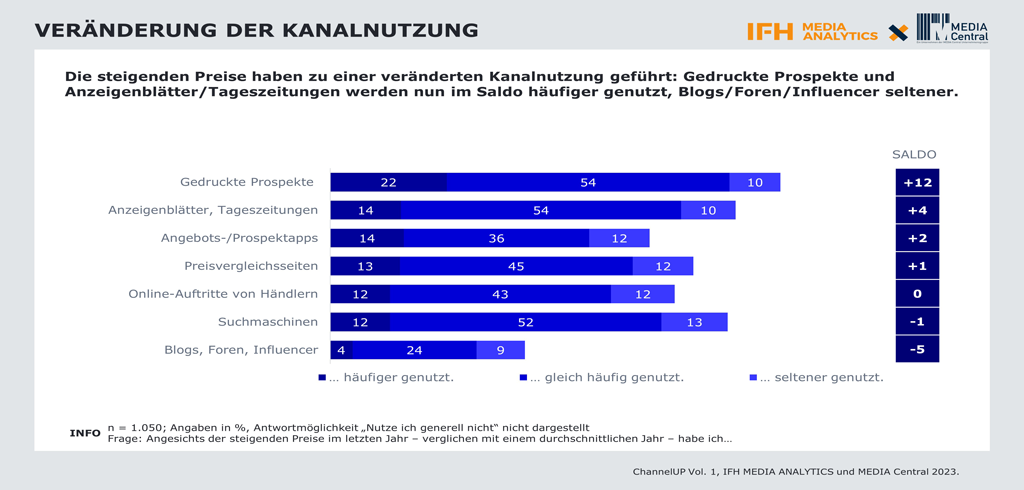

Channel usage: Print is the big inflation winner for the search for offers

As part of a representative survey conducted by IFH MEDIA ANALYTICS and MEDIA Central, we asked consumers about changes in the channels they use to search for offers in light of the current price increases compared to the previous year. Printed brochures (+12%), advertising papers/daily newspapers (+4%) and offer and brochure apps (2%) in particular are becoming increasingly relevant. By contrast, some online channels are clear inflation losers: Blogs, forums and influencer advertising recorded a decline of 5 percentage points.

The figures make this clear: Retailers need to keep an eye on the channel preferences of their target group and adapt their channel mix to dynamic changes in consumption. Print is seen as a well-known and credible shopping and spending aid – especially in times of inflation – and is also perceived as a consistent, reliable and clear companion in the jungle of offers. Offer and brochure apps are also proving to be a resilient digital supplement to print and a long-established channel in times of crisis. Blogs, forums and influencers, on the other hand, are less crisis-proof – as the focus here is often (also) on luxury products and not just essential products.

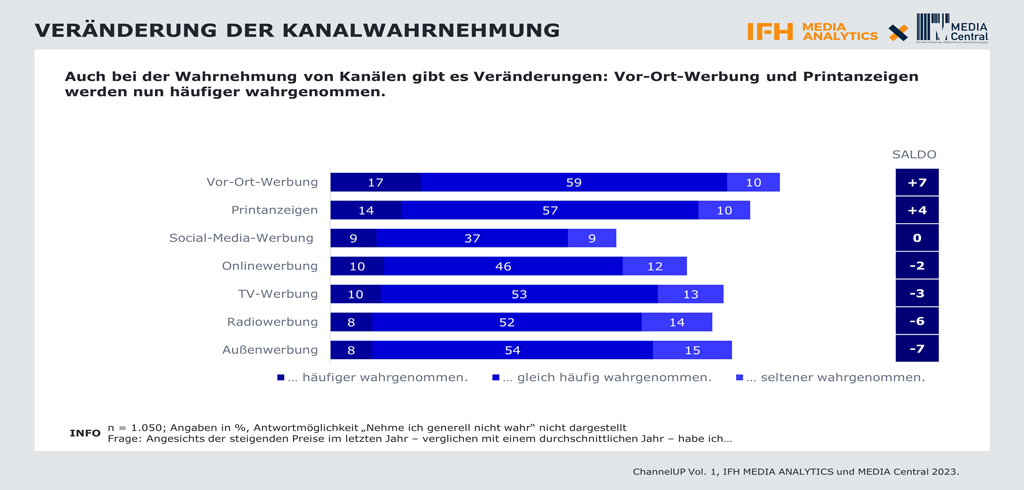

The perception of offers is declining

Not only the active use of channels for communicating offers, but also the passive perception of offers via advertising has changed as a result of the price increases. In general, most channels have lost ground compared to the previous year: outdoor, radio, TV and online advertising (-7, -6, -3 and -2 percentage points).

Here too, consumers’ receptiveness to advertising for products they may not necessarily need seems to have decreased. The only passively perceivable channel with an increasing importance of 4 percentage points is printed advertisements. Print therefore also functions as a reliable and credible anchor in times of crisis in the area of passive advertising. In addition, local offers have increased by 7 percentage points: Consumers also seem to pay close attention to offers or consciously compare (offer) prices when shopping in stores. Opportunities for the communication of offers and the marketing of retailers are therefore still numerous in the area of passive advertising, even if the receptiveness of consumers has decreased slightly.

Would you like to learn more about active and passive channels of offer communication in times of inflation and digitalization? Click here for ChannelUP Vol. 1 and ChannelUP Vol. 2.